ROE is one of the formulas used to assess a company’s success when it comes to creating profits or earnings. The ROE formula is typically utilized by people active in the worlds of investment or business. So, how do you compute ROE?

Understanding and Calculating ROE

ROE is significant in business since it may be used to assess a company’s ability to generate profits. The capital used is known as equity, and it has been distributed to shareholders.

The owner’s entitlement to the company’s assets when the number of obligations is reduced is referred to as equity. Capital and equity can be used interchangeably. The ROE formula can be used to compute all of this. ROE will be determined as a percentage, whereas the formula compares net profit after tax.

Also read: 2 Ways to Calculate ROI and Its Uses

This ratio will create earnings or investments based on the shareholders’ book value. This ratio is frequently used to compare two or more companies. Identifying strong and cost-effective investment possibilities

Key RoE (Return on Equity) Points

Stockholders frequently inquire about how to calculate Return on Equity. Not only that, but potential stockholders and their management are also keen. The outcomes of these computations will serve as a standard for the production of shareholder value.

This suggests that the larger the ratio, the greater the company’s value. Of course, it will be appealing to investors looking to invest in the company. As a result, achieving a high ROE ratio number is critical.

Not only are you looking for techniques to compute the ROE formula. There is one more metric that can be used to assess the performance of a business. ROA is its name (Return On Asset). ROE and ROA are both very significant to investors.

The reason for this is that ROE and ROA can be used to select stocks with high profit potential. So, before you buy any stock. It is preferable to know the company’s ROE/ROA ratio ahead of time.

Also read: 5 Easy and Fast Ways to Create Ledgers

As a dependable investor, you will analyze both ratios so that you do not invest in a firm irresponsibly. If you already know what ROE and ROA mean, the next step is to use a formula to compute ROE.

How to Calculate ROE Using a Simple Formula

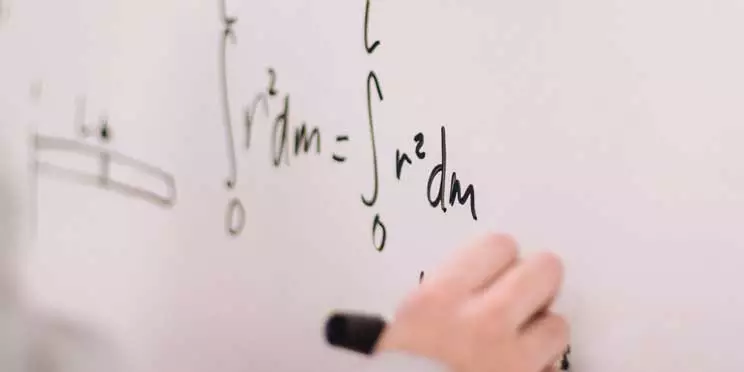

After understanding what ROE and ROA signify for the business. The following formula will be used to calculate a company’s ROE. As previously stated, the foundation of calculating ROE is net income and shareholder equity.

As a result, the formula is.

Return On Equity (ROE) Equals net profit after tax divided by shareholder equity multiplied by 100.

Typically, ROE is calculated as the owner of the common shares, also known as Common Shareholders. To have a better understanding of how to calculate a company’s Return on Equity. There will be several samples of ROE questions to help you understand them better.

Example 1: Using Financial Statements to Calculate ROE

In 2017, a Maju Bersama firm has equity of Rp. 500,000,000.00 for each shareholder, with a net profit of Rp. 2,000,000,000.00. So, here’s how you calculate the Return on Equity.

ROE = Rp. 2,000,000,000.00: Rp. 500,000,000.00 x 100 = Rp. 400,000,000.00

The actual ROE is then 400 percent. What a fantastic deal for a business. So prepare ready since the company will be visited by a large number of investors.

Also read: Understanding Capital and its Types and Benefits in Business

Example 2: Calculating Return on Equity

The average shareholder equity in Tigaraksa Company is Rp 750,000,000. while the net profit at the time was Rp. 1,500,000,000.00 The ROE is then calculated as follows.

ROE = Rp. 1,500,000,000.00: Rp. 750,000,000.00 x 100 = Rp. 200,000,000.00

As a result, the company’s ROE is 200 percent. This ratio is likewise high for a business. As a result, there will be a large number of investors interested in investing in the company.

It should be noted that if the above-mentioned ROE calculation results are near to one, the company is highly good at using equity capital. As a result, it has the potential to create a substantial income. In the meantime, if the ROE is near to zero, the corporation is less capable of managing shareholder equity.

5 Excel Methods for Calculating ROE

Now that you’ve learned how to calculate ROE using a formula, there’s another program that might be simpler. This is how to compute ROE in Excel. This method may be simpler because no manual calculations are required. Here’s how to do it with Microsoft Excel.

- Open Microsoft Excel, then right-click on columns A, B, and C, then left-click on Column Width, and set the value for each column to 30. Click the OK button. Continue by entering the firm name in column B1 and the names of other companies in column C1.

- In column A2, enter the net profit. Equity is shown in column A3, and Return on Equity is shown in column A4. Then, in columns B, B3, C2, and C3, enter the appropriate value to describe.

- On Facebook Incorporated, for example, has a profit of $2.925 billion and equity of $36.096 billion. Twitter Incorporated, on the other hand, made a profit of $577.82 million and equity of $3,626,403,000.

- As follows is how to enter it. In column B2, enter = 2925000000 and in column B3, enter = 36096000000. Then, in column B4, put the formula =B2/B3. While Facebook Incorporated has an equity of 8.10%.

- Then, in column C2, enter = -577820000 and in column C3, enter =3626403000. Then, in column C4, enter the formula =C2/C3. As a result, Twitter Incorporated’s ROE is -15.93 percent.

Twitter Incorporated’s results will be less profitable and may result in a loss, but Facebook Incorporated’s results will be profitable. When the findings of how to calculate the Return on Equity of the two companies are compared.

Also read: 4 Benefits and How to Prepare a Simple Income

How to Calculate the ROE of a Profit-Promising Company

ROE analysis will be very useful in determining a company’s ability to employ the capital that it has gotten. As a result, as an investor, you must be vigilant in gathering diverse information on a company’s ROE.

In the findings of how to calculate ROE, for example, a corporation has a history of ROE records of 10%. This sum, of course, will not pique the interest of investors. They will second-guess their decision.

The reason for this is because investing in these companies is fraught with danger. The corporation is less able to maximize or cannot or cannot use its capital to generate profits for the company.

How to Make Use of ROE Data

After learning how to calculate ROE, you must understand how to use the results in order to avoid being caught in a loss. There are numerous methods for comparing and analyzing a company’s ROE outcomes.

The first stage is to compare the company’s ROE over the prior 5-10 years. The goal is to determine the company’s growth rate. Although it is not guaranteed, the average acquisition index can be seen.

The second stage is to compare businesses to one another. It must, however, be a company of the same size and industry. It’s possible that the poor ROE is the result of a low profit margin.

The last stage is to select a company with real, growing profitability. The property field is one example. Because the human desire for their own dwelling will increase, the growth rate will be very high.

Also read: Understanding Complete Accounting Objectives, Benefits, and Functions

Calculate ROE with SAP Business One

There are two methods for calculating ROE: using a formula and utilizing Excel. Both can be utilized when necessary. Use the one you believe will provide the most accurate ROE.

So that people can think about it before opting to invest in something. You can utilize SAP Business One to acquire the results faster than calculating ROE manually.

This program will be quite beneficial in the field of business management. Make use of the SAP software straight away. Please see the following website for more details.